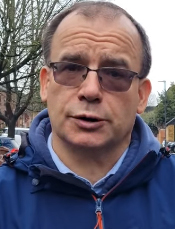

Harrow Council is facing mounting criticism after proposing service charge increases of up to 70 percent for leaseholders in council-owned blocks, a move residents warn will heap unsustainable pressure on families already struggling with rising living costs. Harrow West MP Gareth Thomas (photo), who says he has heard first-hand from affected residents, said the new costs would intensify financial strain on households already feeling stretched. “That is why I am asking the Conservative councillors who lead Harrow Council to urgently review these planned changes, to bring the charges down, and to think much more carefully about the financial circumstances of people living in Harrow before they take such steps,” he said, as campaigning gathers pace ahead of the May 2026 council elections.

Harrow West MP Gareth Thomas (photo), who says he has heard first-hand from affected residents, said the new costs would intensify financial strain on households already feeling stretched. “That is why I am asking the Conservative councillors who lead Harrow Council to urgently review these planned changes, to bring the charges down, and to think much more carefully about the financial circumstances of people living in Harrow before they take such steps,” he said, as campaigning gathers pace ahead of the May 2026 council elections.

The increases apply specifically to council leaseholders – many of whom bought their homes under the Right to Buy scheme – where Harrow Council remains the freeholder and is responsible for setting and collecting service charges. For these residents, the charges are mandatory and non-negotiable.

A jump of this scale could add hundreds or even thousands of pounds a year to household bills. A family currently paying £2,000 annually could see that figure rise to £3,400 – a sharp escalation at a time when mortgage repayments, rents, energy bills and food costs remain significantly higher than pre-crisis levels.

Working households who have already absorbed interest rate increases of several hundred pounds per month say there is little left to cut. Pensioners on fixed incomes and single-income families are particularly exposed. Unlike discretionary spending, council service charges cannot simply be deferred; non-payment can ultimately lead to legal action.

Critics argue the scale of the increase far outstrips inflation and wage growth, raising serious questions about financial management and whether council leaseholders are being asked to absorb wider budget pressures. There are also concerns that higher ongoing charges could make former council flats harder to sell, undermining the financial security of residents who invested in home ownership.

For families already at their limit, a 70 percent rise in compulsory housing costs is not a routine adjustment. It is a financial shock that risks pushing many closer to debt – and, for some, into crisis.

- Comment

- Reblog

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.